Alaska’s state government is forecast to receive $791.3 million more in revenue over this year and next year than was projected last fall.

The Department of Revenue released its spring forecast on Monday. It’s an update to the fall projection. The revenue forecast increased by $331.7 million through June and $459.6 million from July to June 2022.

On Tuesday, Revenue Commissioner Lucinda Mahoney described to the Senate Finance Committee the reason for the change.

“We’ve incorporated our actual results to date and have forecast an increase of revenues for the remainder of this fiscal year, with the primary driver being the price of oil,” Mahoney said.

The price of oil and oil production in the state are both expected to go up this year.

The oil price forecast rose $7.73 per barrel this year and $13 per barrel in 2020.

The state forecast is for an increase in production of 4,700 barrels per day this year and 20,100 barrels per day next year.

Even with the improved forecast, the state doesn’t have enough money to pay the full $2 billion in permanent fund dividends under the formula in a 1982 state law without drawing from other sources. Gov. Mike Dunleavy has proposed drawing more from the Alaska Permanent Fund’s earnings reserve account than was planned in a different law, enacted in 2018. His proposal has raised concerns about the long-term health of the fund.

As for the state’s other sources of income — which include taxes for non-oil corporate income, mining licenses, marijuana, tobacco, motor fuel, insurance premiums and fisheries — they’re expected to go up by $26 million more for this year than what was projected in the fall, but the outlook for next year is $17.8 million lower than what was in the fall forecast.

The change in these other income sources for both years was due to changes to corporate income taxes, which were affected by provisions of the federal CARES Act.

There was no change in the planned draw from permanent fund earnings since that amount is based on revenue growth before this year.

Department of Revenue Chief Economist Dan Stickel said the forecast has a high degree of uncertainty.

“Seeing in the news the COVID situation is presenting some room for optimism and [in] the global economy as well, there’s reasons for optimism, and I think our forecast reflects that,” he said.

One area where the forecast isn’t optimistic is tourism. The forecast assumes that large cruise ships won’t visit the state this year, and that there won’t be a full recovery in the state’s tourism sector until 2024. Stickel said the Department of Revenue hopes that the industry improves sooner than that.

The forecast doesn’t account for $1.13 billion that the state is set to receive from the American Rescue Plan Act — the latest relief law enacted earlier this month. Another $230 million is headed to Alaska municipal governments.

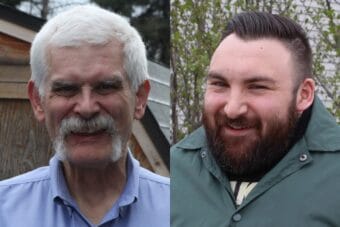

Bethel Democratic Sen. Lyman Hoffman said he expects the administration to consult with lawmakers before finishing its plans for how to spend that money.

“I’m looking forward to working with the administration to make sure that the input of the Alaska Legislature has its so-called fingerprints on the document before the expenditures happen,” said Hoffman, the only Democrat in the Senate majority caucus.

The Department of Revenue is waiting for guidance from the federal government on how it can spend the money.