At Sealaska Corporation’s upcoming annual meeting, five seats are in play on its 13-member board, and candidates are seeking support from the more than 22,000 people holding shares. But one of the biggest contests will be how elections will be carried out in the future.

Former Sealaska board member Ed Thomas says about a fifth of shareholders don’t have a particular candidate in mind, “but they still want to be supportive of Sealaska; there’s an opportunity to give their votes to the proxy holders to vote as they wish.”

That creates a bloc of votes that are called “discretionary” because they can be used at the discretion of the board majority. And it’s basically like handing over an unmarked ballot for a corporation’s leadership to ink in the bubbles.

Critics like Thomas say this perpetuates the majority members’ ability to retain control. Now, he’s gathered enough signatures to force the issue this spring.

The former board member says any director that’s out-of-step with the majority risks losing their endorsement and with that — access to the pool of discretionary votes controlled by the majority.

“And what that does is sends a message to any new member,” Thomas told CoastAlaska from his retirement home in Washington state. “That you got to go along with their thinking otherwise — you can’t think independently — otherwise, you’re out.”

A former president of Central Council of Tlingit and Haida Indian Tribes of Alaska, who grew up in Craig on Prince of Wales Island, was first elected to Sealaska’s board in 1993 as an independent. In subsequent years, he was re-elected as part of the board slate up until 2019 when he says he apparently fell out of favor and was dropped from the slate of endorsed candidates.

Shareholder resolutions would amend Sealaska’s bylaws

His proposed resolution would restrict the use of discretionary votes in Sealaska’s elections. It would require candidates to be elected on the strength of shareholders checking off their names.

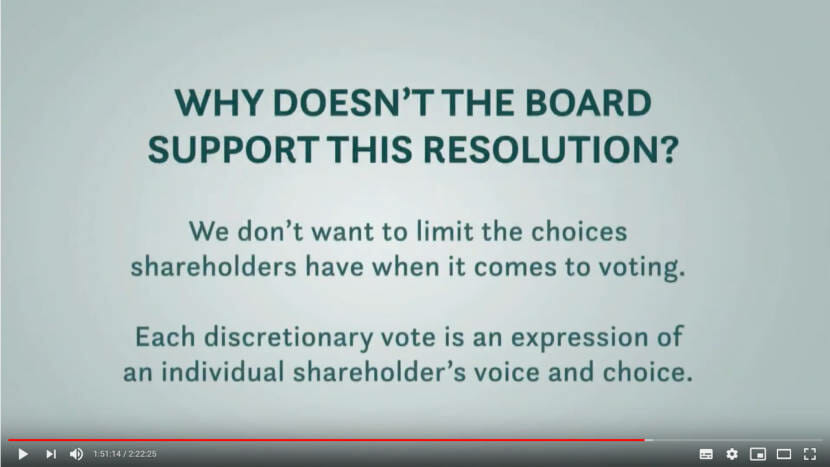

But Sealaska’s board majority opposes the measure. Board and executive leaders declined an interview request but have released statements pointing out that past efforts to stamp out discretionary voting have failed.

Thomas says it’s understandable that the board’s leadership wants to keep the status quo.

“Because it does really pretty much ensures that when election time comes, so you can shift around the votes to make sure their candidates get put back on,” he said.

It’s not the only election reform resolution put on the ballot by shareholders. Anchorage shareholder Lisa-Marie Ikonomov is pushing a separate measure that would require more detailed reporting of the final vote count. That means a candidate’s election returns would have the number of directed votes cast by individual shareholders and the discretionary votes controlled by the majority on the board in separate columns.

“This resolution does not say that they can’t use discretionary voting,” she said in a recent interview. “What it says is they just need to be honest and truthful and report those full totals to shareholders. They shouldn’t be able to hide any vote count from any shareholder.”

Simmering tensions from shareholders concerned about executive compensation

Sealaska is a major economic player in Southeast Alaska. Its business portfolio includes seafood, real estate and until recently timber across more than 360,000 acres. The Native-owned corporation reported nearly $700 million in annual revenue with more than $55 million in net profits last year, according to its most recent annual report. And it pays out cash dividends each year to its shareholders and funds educational work through its cultural arm, Sealaska Heritage Institute and others.

Yet there have long been competing factions vying for control of the organization. In recent years, critical shareholders have decried the take-home pay of Sealaska’s leadership which tops more than $2.2 million for its chief operating officer and more than a quarter million dollars for its full-time board chairman.

Sealaska is one of the 13 original corporations established by the Alaska Native Claims Settlement Act. The legislation was a sea change for Alaska’s indigenous people who received shares in regional, village and urban corporations based on ties to their traditional homelands.

But Ikonomov says ANCSA corporations like Sealaska have in the past half-century become a lot more than just profit-driven corporations.

“They’re our voice in politics, they’re our voice in the community,” she said. “We look at those positions as not just having that business component, but also in a lot of ways, the representation component of us as shareholders as tribal citizens, as Alaska Native people.”

Sealaska leadership quiet over opposition to shareholder resolutions

Sealaska’s board of directors opposes both shareholder resolutions. But its opposition has so far been fairly low-key. At a May 11 informational meeting for shareholders, aside from a pair of video messages, none of the board members or executives directly addressed the shareholder resolutions.

The board has released statements that say roughly one-fifth of people vote discretionary because they are consciously showing their support for the corporation. It notes that six similar proposals have been voted down since 1992.

The resolutions still face tough odds. Under Sealaska’s bylaws, a shareholder resolution requires support from the majority of all shareholders to pass. That’s challenging because 20% to 30% of shareholders don’t vote, meaning that two-thirds of those that do would need to vote yes.

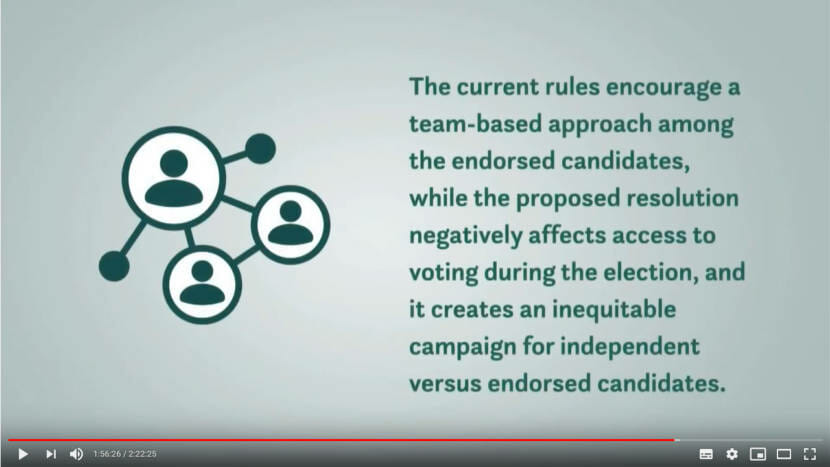

The Sealaska Corporation also told shareholders that its current bylaws encourage a “team-based” approach, where the endorsed nominees work together and support each other.

In election materials distributed to shareholders, it says the proposed changes could make, “some nominees look weak if they did not seek directed votes, and instead sought discretionary votes in support of the team.”

Ed Thomas, the former Sealaska board member, says he feels the corporation will be stronger if it has fairer elections.

“I personally feel that it is not anti-Sealaska,” Thomas added. “You look at some of the folks that are young, up and comers, we really have positive people. And then they get a fair chance to go forth in their elections without having the cloud of having to bow to a leader in order to get elected.”

Sealaska shareholders have until June 25 to vote by returning their proxies. Resolutions and the board of directors elections will be made at Sealaska’s annual meeting.