Alaska Gov. Mike Dunleavy did not orchestrate the firing of former Alaska Permanent Fund Corp. executive director and CEO Angela Rodell, a special investigation has concluded.

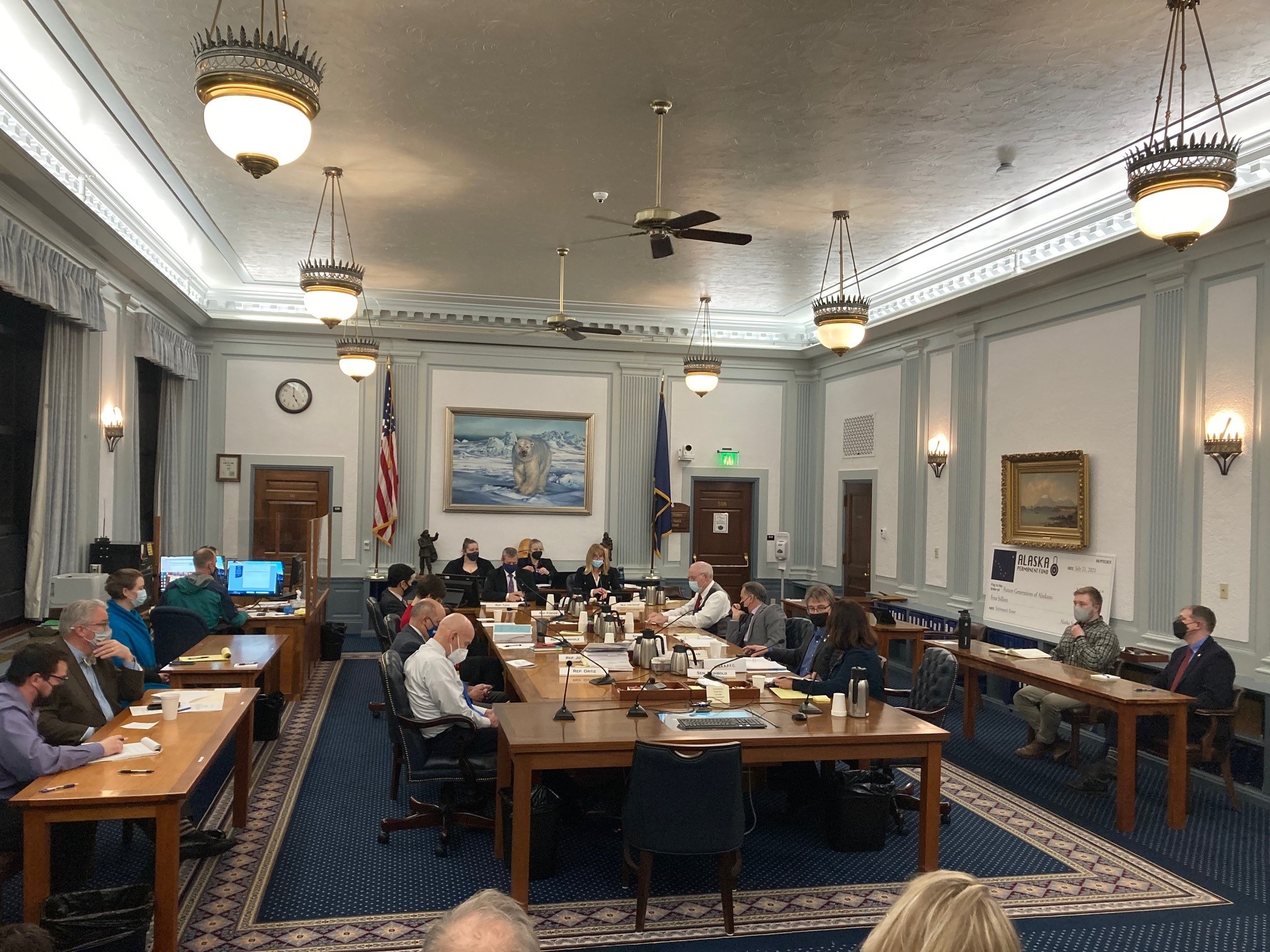

“The governor’s office had no impact or influence upon the decision,” special investigator Howard Trickey told members of the Legislative Budget and Audit Committee on Thursday.

Trickey’s investigation, ordered by the committee in January, found Rodell’s firing was at least partially based on a “deficient” evaluation process but could be justified by trustees’ personal experience and a lack of confidence in Rodell’s leadership.

“A loss of confidence in the chief executive of an organization such as the APFC is a sufficient legal reason under the legal standards applicable to at-will employment in Alaska,” the investigation concluded.

Five of six Alaska Permanent Fund Corp. board members voted for Rodell’s removal in December, following the corporation’s most successful year on record. Since then, two of the members who voted for removal have left the board, as has the member who did not.

A spokesperson for the Permanent Fund Corp. said the agency is reviewing the legislative report and will respond after its review.

Rodell did not respond to a text message seeking comment.

This week, the corporation released the results of a third-party investigation ordered by the board that said “deviations from APFC processes were minor” and would not have changed trustees’ decision.

“Governor Dunleavy always said he had no involvement or knowledge of the Permanent Fund Corporation’s Board of Trustees’ decision to release its executive director, and is satisfied with that finding,” said Jeff Turner, Dunleavy’s deputy communications director, when asked about Thursday’s report.

The report concluded that trustees lost confidence in Rodell for a variety of reasons, including a belief that Rodell had made public comments at odds with the governor’s administration.

Members of the committee said they didn’t see Rodell’s comments in the same light.

“It was a general breakdown in the relationship between the executive director and the board,” said Rep. Neal Foster, D-Nome, and a member of the committee.

“There was no true objectivity regarding the removal of her, and it ended up leaning to more subjectivity, and that’s of concern to me,” said Sen. Lora Reinbold, R-Eagle River.

Sen. Natasha von Imhof, R-Anchorage and the chair of the committee, used the release of the report to advocate changes in the makeup of the corporation’s governing board, saying that although the report found no illegal activity, it did identify problems that should be resolved.

Rep. Andy Josephson, D-Anchorage, and a member of the committee, introduced legislation earlier this year to change the board’s membership. That bill failed to advance.

Thursday’s report resolves nine months of uncertainty that began with Rodell’s firing.

The reasons for her removal were unclear at the time, and Rodell claimed it was an act of “political retribution” by the Dunleavy administration, which had proposed a plan to increase spending from the Alaska Permanent Fund. That plan was later abandoned.

The governor and the chairman of the Permanent Fund’s board of trustees denied Rodell’s accusation. Public records, including a review of Rodell’s state personnel file, showed years of friction between her and board members, with some negative reviews predating Dunleavy’s term of office.

The $74 billion Alaska Permanent Fund Corp. was designed to be politically neutral, but members of the Legislature said they were concerned by Rodell’s claims and a lack of answers from trustees.

Investment earnings from the corporation’s assets provide between half and two-thirds of the state’s general purpose revenue, depending on the price of oil.

Citing their concerns and the importance of the Permanent Fund, members of the Legislative Budget and Audit Committee authorized up to $100,000 for an unusual special investigation. That figure was later increased to $150,000.

When trustees balked at voluntarily speaking with the special investigator, the committee sought and obtained subpoena powers from Senate President Peter Micciche, R-Soldotna, and Speaker of the House Louise Stutes, R-Kodiak.

Trustees, after threatening to challenge the committee’s legal authority, agreed to voluntary interviews that were conducted in June.

During those interviews, trustees outlined their reasons for discontent, which included a summer 2021 press release outlining plans for the corporation’s shutdown if legislative budget negotiations failed.

Corri Feige, commissioner of the Alaska Department of Natural Resources and a member of the board of trustees, said in a deposition that Rodell’s statement about the shutdown was “wildly inappropriate,” in part because it wasn’t reviewed by the board.

“I had no idea where this came from. It had, I think, an adverse impact on the fund because it unnecessarily frightened the public, and I thought it was absolutely out of bounds,” Feige said.

Other board members had similar reactions when asked about the issue.

Rodell made the statement a week before the shutdown deadline, before the governor’s office released a list of which offices would be affected.

Feige was one of two members of Dunleavy’s cabinet who also sat on the corporation’s board and voted for Rodell’s removal.

The other was Revenue Commissioner Lucinda Mahoney, who said she was concerned by an October 2021 board of trustees meeting in which Rodell hired a mediator to work between her and the board on issues of executive pay.

“Toward the end, obviously, I questioned her leadership at the end,” Mahoney said.

Board member Ethan Schutt, now the board’s chair, expressed similar concerns about the October meeting, during which Mahoney and Feige supported an unsuccessful move to eliminate some proposed Permanent Fund staff pay.

Mahoney had expressed concern about the optics of raising staff pay when the state wasn’t paying Alaskans the Permanent Fund dividend amounts under the formula in a 1982 state law.

Mahoney organized an employee-satisfaction survey that showed significant disapproval of Rodell among investment staff. Trustees generally credited investment staff, rather than Rodell herself, with the fund’s performance in 2021, and discounted Rodell’s influence in hiring members of that staff.

“Their consensus was lack of confidence. They all had an independent and separate reason for lack of confidence,” Trickey said.

Asked whether the investigation was worthwhile despite its cost, von Imhof said she believes it may be, if it inspires changes in the system.

Rep. James Kaufman, R-Anchorage, and a member of the budget and audit committee, said he believes it was worthwhile in the same way that a clean audit is worthwhile.

“You do that for assurance purposes, and that’s OK in the world of auditing,” he said.

Correction: Three of the trustees on the board at the time of Rodell’s firing are still on the board. The initial version of this article incorrectly stated that four of the six had since left the board.