Alaska Gov. Mike Dunleavy, once a staunch opponent of tax increases, said Thursday that they are now a core part of any long-term state fiscal plan.

Speaking in a news conference, the governor said there is a broad recognition in the Legislature and in his office that the state can no longer rely on commodities, such as oil, to balance the state’s budget.

“To simply ride oil in a do-or-die situation for the state of Alaska is folly. It’s probably not a good idea,” he said.

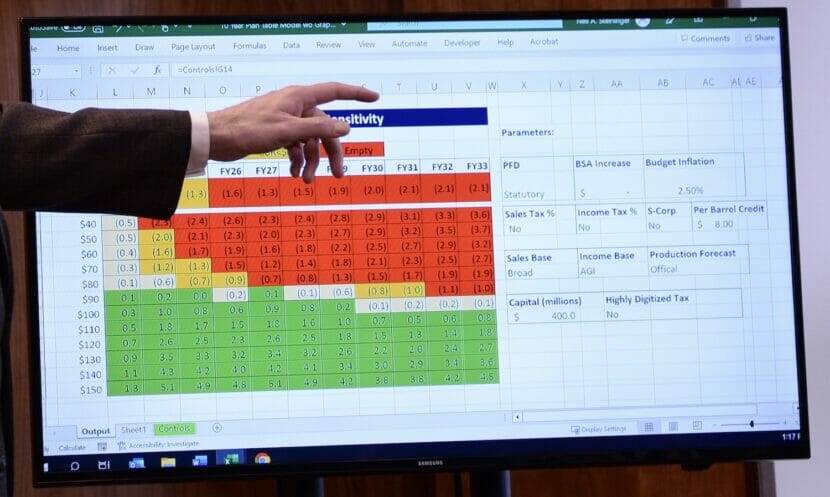

Dunleavy confirmed prior reports that he intends to propose a statewide sales tax, saying work on the proposal could be done Thursday or Friday. It was not clear when the idea would be introduced in the Legislature.

“I would start off with a low percentage sales tax, probably 1%. And the reason I say that is, it’s really about stabilizing our fiscals,” he said.

The governor’s legislative director, Laura Stidolph, said the governor’s draft proposal is currently 2%. That could be changed before introduction.

Regardless of the format, it’s a significant change for a governor who has never proposed a tax increase since entering office in December 2018.

Last year, Dunleavy vetoed a bill that would have raised the state’s minimum age for e-cigarettes because it included a small tax on e-cigarette products. In his veto message, dated Sept. 8, he said, “ultimately, a tax increase on the people of Alaska is not something I can support.”

The year before that, he proposed making all new state taxes contingent upon a statewide vote. That idea wasn’t picked up by lawmakers.

Dunleavy said he now believes that “a broad-based solution that doesn’t gouge or take huge parts from one sector (of Alaska) or another, or penalize one sector for another is probably the most important thing we can do.”

State lawmakers this year have already introduced a variety of tax proposals, including ideas to change the state’s existing oil and gas tax system, a statewide sales tax, a state per-person head tax and an income tax.

Alaska has never had a statewide sales tax or a statewide property tax (except for oil and gas equipment), and it hasn’t had an income tax since 1980.

From 1980 through 2018, oil revenue was the state’s main source of income, and since 2018, an annual transfer from the Alaska Permanent Fund’s earnings has been the main source.

Adding a new tax would be a major change, and none of the ideas proposed so far has advanced significantly in the legislative process, but lawmakers and the governor noted on Thursday that there’s a general consensus that at least one option is needed.

Both the governor and members of the House majority said that any tax must be accompanied by other legislation in order to be a full long-term plan. Speaker of the House Cathy Tilton, R-Wasilla, said those elements include a new formula for the Permanent Fund dividend and something to encourage economic growth, as well as something to raise revenue.

“Everything that we do in a fiscal plan needs to run together, and that it needs to be something that the entire Legislature can agree upon,” Tilton said.

Getting agreement on those various pieces isn’t easy in the Capitol, where both House and Senate are led by coalition majorities that include varying numbers of Republicans, Democrats and independents.

“It’s a diverse Legislature,” Dunleavy said. “Certainly I have my own ideas on what some of the components (of a fiscal plan) would be. But what I think is really important to remember is that the vast majority of folks in the Legislature … want to solve this issue.”

Lawmakers are still trying to figure out what the components of that plan will be and how they will fit together, he said.

“That’s why something like this is taking a while,” he said.

There are fewer than three weeks remaining in the regular legislative session, and Dunleavy said he is already discussing the possibility of a special session — possibly in the fall — to address the topic.

For the moment, there isn’t agreement about whether — or when — that will happen, and Dunleavy said he’s not prepared to rule out the possibility that lawmakers reach consensus before the end of the regular session.

“Don’t be surprised if there’s some quick, fast movement to be able to put together a fiscal plan, it may or may not happen in this timeframe,” he said.

This story originally appeared in the Alaska Beacon and is republished here with permission.