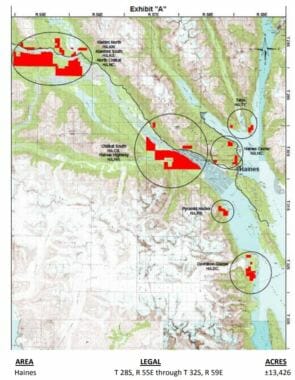

The University of Alaska announced a timber sale in the Haines area last year. That contract remains unsigned.

There are various factors slowing the 10-year timber sale the University of Alaska announced last March.

“There is no contract signed yet,” said Morgan Howard, the Liaison for the University of Alaska Land Management office. “The potential buyer is still estimating the overall volume and looking at the infrastructure that’s needed, such as log transfer facilities, also monitoring potential tariffs.”

The Land Management office previously announced it would hire a local caretaker for the land, but Howard says that is on hold until a contract is signed.

This isn’t the first delay. In November of last year, Land Management cited a slowdown in negotiations.

This time, Howard says that timing and infrastructure are the issue. He says the university wants to time the harvest with adjacent landowners: the state and the Mental Health Trust. That way they could share resources.

“The vision was this could be a continuous long term employer in the Chilkat Valley. A small industry that could be viable if everybody worked together. So far it’s just us that’s moving forward,” Howard said.

And though the harvest would eventually require a log transfer facility in the Haines area, he says they could get started without one.

But the last big issue is one that the University really can’t control: the market. The tariffs that Howard says the university are monitoring are part of what’s been called a trade war between the U.S. and China. Tariffs are important here because Howard has said the timber from the Haines sale would go to China.

Rose Braden says the top U.S. markets are Canada, Mexico, China and Japan. She’s the executive Director of the Softwood export council in Portland, Oregon. She keeps tabs on the $950 million U.S. export market for softwoods—including the spruce, hemlock, and lodge pole pine that grow around Haines.

Last year, the Trump Administration placed a tariff on many Chinese imports. The Chinese government answered back with a 10 percent tariff on certain U.S. products, including timber.

Braden says the market for softwoods has been relatively stable for the last four or five years. But softwood exports to China?

“If you look at first quarter 2018 versus first quarter 2019 we had a 54 percent decline,” Braden said.

Fifty four percent is significant. And that’s a decline after the imposition of ten-percent tariffs. This month China increased the tariff to 25 percent.

Back at the Land Management office, Howard says he can’t predict what may happen with trade between now and the sale. And again, that cooling market is one of many factors.

He didn’t acknowledge any causality, but now the University is looking at what kind of money it could make by keeping trees in the ground. Last year they dismissed a suggestion from the community to consider selling carbon credits instead of harvesting timber. That’s a program where big polluters in California can offset their impact by buying credits, which represent real carbon sequestering things like trees. Sealaska made a multi-million dollar deal to do that last year.

“We’re working with everybody knowledgeable in Southeast in regards to carbon credit. There are a couple firms we’re talking to we’re talking to a couple of landowners that have already has sales,” Howard said.

He says participation in the program is still a few years out. It wouldn’t just be for the Haines area—it’s on the table for all university land. In the meantime, they’re still moving forward with the timber sale. But he says ten years is a long time, so some of the land in the Chilkat Valley could potentially be sold in the carbon credit program.